SYRUP - A Bet On Onchain Credit Expansion

From Unsecured Lending to a $2.6B AUM On-chain Credit Leader

Disclaimer: The following report reflects my own personal views, research, and forward-looking assumptions about Maple Finance and its native token $SYRUP. It does not constitute financial advice or a recommendation to buy, sell, or hold any asset. I hold a position in $SYRUP and therefore have a vested interest, which may result in biases. All data, metrics, and valuations cited in this report are accurate to the best of my knowledge as of mid-to-late June 2025, and figures may have changed since.

The opinions expressed are solely my own and are provided for informational purposes only, intended to outline a personal investment thesis.

Introduction

This report lays out my investment thesis on $SYRUP, representing Maple’s growth into becoming the leading on-chain secured credit platform. The thesis focuses on the belief that the next leg of DeFi institutional adoption will not be driven by speculative trading or undercollateralized loans, but rather credit infrastructure that brings institutional and retail money into on-chain overcollatearlized loan books.

Background of Maple

Maple Finance launched in 2019 building decentralized capital markets for institutional borrowers, beginning with unsecured lending to trading firms. Maple was co-founded by Sidney Powell, a former structured credit analyst at National Australia Bank, and Joe Flanagan, who brought experience in fintech recruitment and operations.

At the time, DeFi was largely built on the overcollateralized model (e.g. Aave, Compound) where trustlessness was enforced by excess capital. Maple went the other direction by betting that institutional reputation could replace asset collateral. Instead of trustless lending, Maple allowed trust-based lending, letting pool delegates underwrite loans to market makers and trading firms based on credit risk assessments.

They quickly gained traction during the 2021 bull market by offering undercollateralized loans to trading firms. These firms included Alameda Research and Orthogonal Trading who managed to obtain such loans due to their reputation, business history, and off-chain financials. In its first year, Maple originated over $1B in total loans and positioned itself as the institutional DeFi lender.

Addressable Market

The global private credit market which typically includes direct lending, distressed debt, and specialty finance, has grown from just under $500B in 2014 to just over $1.5T by the start of 2024 at a CAGR of ~12%. The TAM is projected to hit almost $3T by 2028.

Zooming into the crypto-native segment, onchain private credit (institutional lending) is still nascent, but scaling rapidly. Data from rwa.xyz as of June 2025 puts onchain private credit market size at $14 billion, up from ~$3B just two years ago, which is a ~140% CAGR.

This growth can be mainly attributed to improvements in credit infrastructure such as underwriting standards and risk frameworks by platforms like Maple, Clearpool, and Goldfinch that directly emulate traditional credit due diligence processes. Additionally, factors like greater demand for capital efficiency (accessing leverage products), and the introduction of custody solutions like Bitgo, Anchorage, have contributed to the growth.

Even if only a modest 1-2% of global private credit migrates onchain, the addressable opportunity still sits at $20-30B near-term, with room to scale well past $100 billion in the mid-long term.

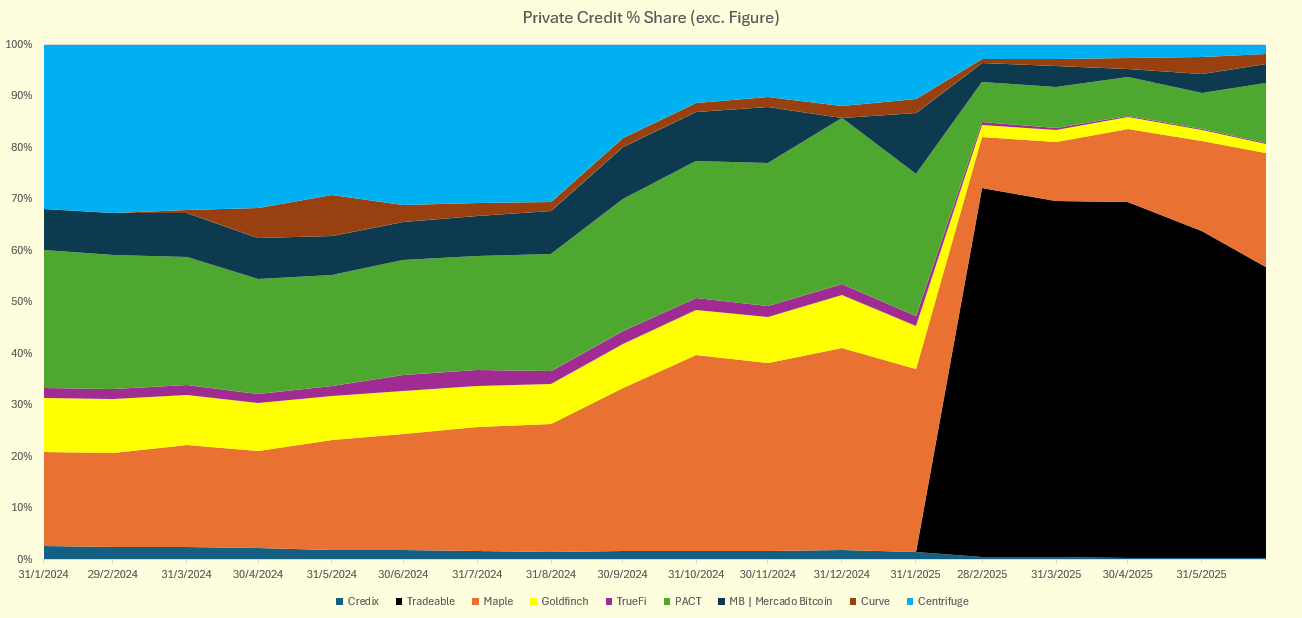

Maple currently has ~25% share (exc. Figure) of the onchain private credit market, and steadily growing.

Undercollateralized Lending: 2022 Defaults

Their original undercollateralized lending model got stress-tested in 2022 when cascading defaults triggered by the collapse of FTX and Celsius exposed Maple’s counterparty concentration and insufficient credit risk controls.

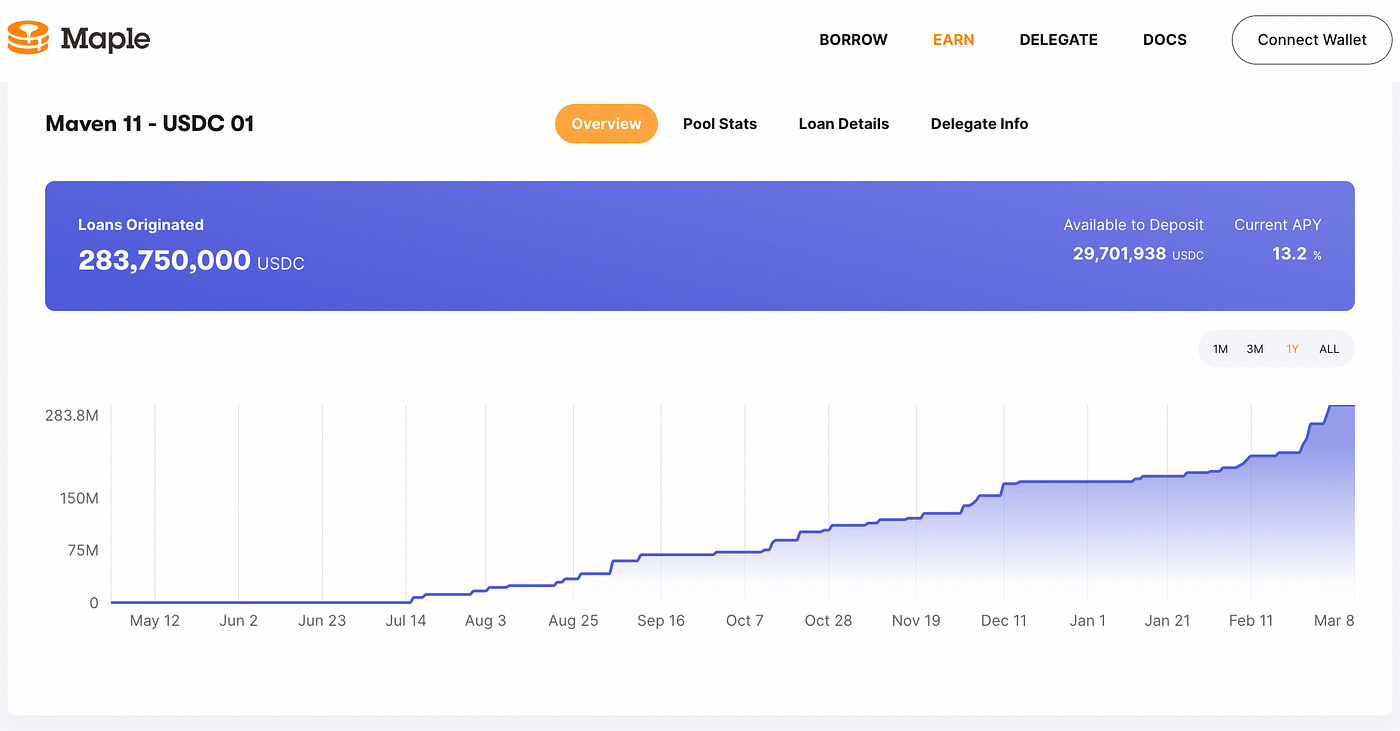

Orthogonal Trading, one of Maple’s earliest borrowers and delegates, defaulted on $36 million in loans after misrepresenting its exposure to FTX and their trading arm Alameda Research. The amount represented about 30% of active loans across the entire protocol at that time. Auros defaulted on another $18 million (has since been repaid). These loans originated from Maven 11’s USDC lending pools.

The losses eroded lender confidence in the peak of the 2022/2023 bear market and forced Maple to reevaluate its risk frameworks and underwriting standards. Delegates (credible experts who launch and manage lending pools) got burned, lenders lost principal, and Maple took a reputational hit.

Transition to Maple 2.0 Architecture

Maple responded by launching Maple 2.0 to address the core weaknesses exposed during the 2022-23 credit events by tightening delegate requirements and default processes. Maple 2.0 introduced a modular lending framework that allows for more granular control over capital flows, clearer revenue attribution, and faster recovery in the event of defaults.

Pool Contract

The pool contract was one of the most critical components changed in Maple 2.0. Rather than bundling all functionality into a single contract, Maple introduced a modular design that separates duties into four key contracts: PoolManager, LoanManager, WithdrawalManager, and PoolDelegate roles. The pool contract is also an ERC-4626 tokenized vault, enabling standardized share accounting for lenders and seamless integration with analytics platforms and aggregators. This shift not only improves transparency but also enables more predictable yield and NAV calculations.

The PoolManager configures the pool’s parameters and oversees capital operations. Parameters include: asset liquidity caps, whether the pool is permissioned, % interest.

The LoanManager tracks loans, interest accrual, and repayment logic. A major benefit of having ERC-4626 here is the ability to have multiple LoanManager instances under the same pool. This allows Maple pools to run multiple independent loan strategies or risk configurations that can plug into the same lending pool, while still aggregating back into a single ERC-4626 vault and share system. The architecture also allows Maple to isolate underperforming loan books without disrupting the whole pool.

The WithdrawalManager has 2 redemption logics: cyclical and queue-based redemption mechanisms. The cyclical mechanism holds custody of users’ LP tokens and allows them to withdraw at specified time intervals ("Withdrawal Window") within each cycle after waiting n cycles (the withdrawal delay). This model mimics traditional fund lockups which prevents unexpected drains of liquidity and ensures the pool isn’t forced to liquidate loans prematurely.

Queue-based withdrawals allow lenders to request exits that are processed on a first-in-first-out basis. The syrupUSD pool uses this system where the average withdrawal processing time is 2 days.

For both redemption logics, the exchange rate is determined at the time the withdrawal is processed.

Loan Structures

Maple offers 2 core loan types: Fixed Term and Open Term loans.

Fixed-term loans are structured lending agreements with a defined maturity date, fixed interest rate, and predetermined repayment schedule. When a fixed-term loan is made, the borrowed capital is locked up for the duration of the term with repayments made as a lump sum of principal and interest at maturity.

Open-term loans offer more flexibility, allowing lenders to initiate withdrawals at any time subject to a recall response period (refers to the period a borrower has to repay or refinance their loan). The response period depends from lender to lender, but most are 24-48 hours, with some up to 90 days especially for larger loans. Interest accrues continuously and is paid periodically (average ~30 days cycle on existing loans on High Yield & Bluechip pools).

Each open-term loan lifecycle is governed by a "Next Call Date", allowing lenders to initiate a recall, after which the borrower has a specified response period. This structure supports responsive, overcollateralized lending that minimizes drawdown risks for lenders while giving borrowers flexibility without rigid term lockups.

Refinancing can be done to modify active loans without being unwound or reissued agreed upon by both parties of the loan, the lender and the borrower. Loan terms such as maturity, interest rate, LTV thresholds, loan fees or payment schedules can be adjusted. all for a refinancing agreement, the Borrower can do so for fixed-term loans, while the Lender does so for open-term loans. After the adjustments, each refinancing agreement is still subject to renewed underwriting by the delegate, often involving a re-evaluation of borrower financials, collateralization ratios etc.

The majority of loans on Maple’s active pools today are Open-term loans. This includes their High Yield and Blue Chip Secured Lending, High Yield Corporate Loan, and AQRU pools.

Impairment & Default Handling

Maple 2.0 has introduced new contract upgrades that handle 2 situations where a borrower is at risk of default. 1 is a pre-emptive measure that impairs the loan in the event of a potential non-payment, and the other when the borrower has not made a payment past the grace period.

In the event that a borrower is believed to be unable to repay their loan, the loan will be impaired with the goal of distributing potentail unrealized losses to lenders in the pool. Either the Pool Delegate or the Governor may call the impairLoan function, which immediately moves the loan’s outstanding principal and accrued interest into the pool’s unrealizedLosses bucket. This paper loss reduces the pool’s withdrawal exchangeRate without changing the pools total assets, effectively lowering the pool’s reported NAV for withdrawals.

exchangeRate = (totalAssets − unrealizedLosses)/totalSupplyThe goal of impairing a loan is to avoid a situation where LPs rush for the exit as it would mean realizing the loss before the impaired loan is resolved. Future recoveries are then proportionately distributed to remaining lenders in the pool. New deposits in the pool when there is an active impairment will be at the impaired NAV, but new depositors won’t share any recovories forgone by earlier exiters.

Once a loan’s due date and grace period have passed without payment, the Pool Delegate will label it as a default by calling triggerDefault().

The losses are then realized in the pool’s accounting standards. The principal and accrued interest is forfeited which reduces the pool’s total assets.

totalAssets = cash + ∑assetsUnderManagement

assetsUnderManagement = ∑(outstandingPrincipal + outstandingInterest)Any pledged collateral is repossessed, liquidated and added to the pool’s total assets. All recovered funds first cover protocol fees, then any remaining amount goes to the pool. If losses still remain after the collateral is liquidated, the pool’s first-loss capital (insurance amounts provided by the Pool Delegate) is liquidated to cushion lender losses. Any remaining losses are then shared proportionately with remaining pool LPs.

This is an illustration on how Maple does pool accounting for defaults:

PoolDelegateCover

Pool Delegates are required to provide “first loss capital” which are funds that will be used first in the event of a default to share risk. The Governor is a governance multisig wallet that performs actions based on token holder voting and controls administrative functions of the protocol. It determines what % of first loss capital will go towards cushioning defaults.

However, this cover is currently unused as Maple Direct manages most pools thus the cover contract sits empty.

Margin Call & Liquidations

Maple’s monitoring system aggregates three separate price feeds (Chainlink oracle wrappers) and operates 24/7, triggering margin calls if collateralization ratios hit preset thresholds. Borrowers typically have 24 hours to cure margin calls (Collateral Cure Period) and failure to do so will initiate a liquidation.

In urgent scenarios, collateral can be liquidated immediately if it falls below the hard liquidation threshold, regardless of the collateral cure status. Liquidations are handled through partnered OTC desks to minimize slippage and latency, with CEXs and DEXs being the contingency.

Maple 2.0 Lending Products: Maple Direct

In 2023, Maple pivoted into RWAs and USDC yields, launching

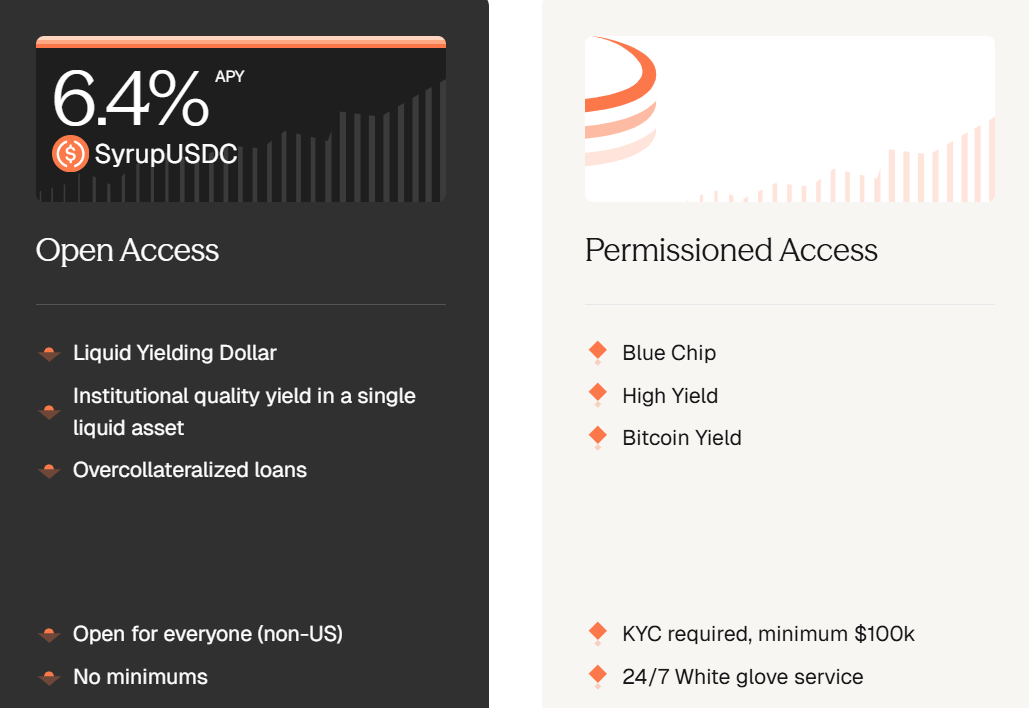

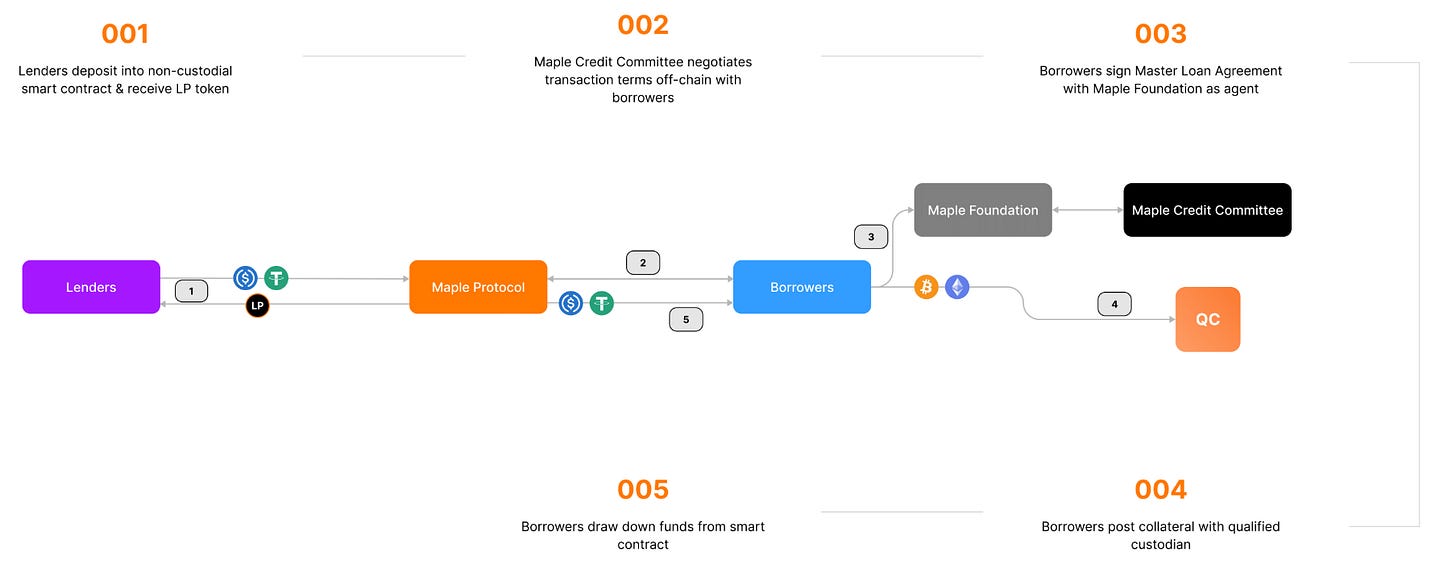

Maple Direct which is their institutional secured lending pools (>150% collateralization), managed by Maple’s in-house credit team and pool delegates, offering fixed-term, secured loans to KYCed borrowers. These pools operate on a permissioned basis where the lenders must undergo KYC and typically be accredited or institutional investors (with minimum deposit of $100K).

Borrowers must go through a rigorous credit due diligence process to demonstrate financial health and ability to post margin. Furthermore, the collateral assets themselves go through an in-depth assessment that mainly looks at liquidity and trading volumes. Primary collateral includes BTC and ETH, with the exception of altcoins in the High Yield vault.

Maple charges management fees, service fees, and origination fees (fixed-term) on loans which are collected by the protocol and delegates.

Underwriting & Risk Management

Borrowers undergo a thorough due diligence process, including KYC/AML compliance, audited financial disclosures, and live interviews with management teams. Lenders also go through a similar KYC process in the onboarding form. All borrowers and lenders are then required to sign a Master Loan Agreement (MLA), which establishes the legal framework governing the deposit terms.

Collateral is also subject to detailed eligibility screening. Maple evaluates three primary factors:

Liquidity: Assesses an asset’s accessible trading venues, historical volumes, and slippage estimates. This informs Maple on the appropriate LTV ratios and liquidation routes.

Historical and implied volatility: Drawing from drawdown analysis in various market conditions (e.g., COVID or FTX crashes). Also looks at factors like future volatility from option markets or future unlock schedules. This informs Maple on appropriate LTV ratios.

Technical integrity: Maple’s smart contract team reviews DeFi collateral such as Lido LSTs or Pendle PT tokens.

Once the processes are done, borrower collateral is held with institutional custodians like BitGo, and the loan parameters are outlined in the MLA (Page 8 & 9) before reflecting on the Maple Direct platform.

Maple manages the health of the loan book through margin calls and liquidation levels with most set above 100%.

Here’s how the flow of funds would look like:

Maple Direct Pools

Currently, Maple Direct offers the following core pools: High Yield Secured (USDC), Blue Chip Secured (USDC), BTC Yield pools High Yield Corporate Loan (USDC), High Yield Corporate Loan (WETH), and Receivables Financing (USDC). These pools contribute just about 50% of Maple’s entire AUM today.

BTC Yield - Maple’s BTC Yield pool is a newer addition to Maple Direct’s suite with a target 4-6% APY. Maple sources yield through Core Network’s dual staking model, pairing BTC with CORE tokens to earn validator rewards. The strategy borrows CORE and deploys it alongside BTC into staking contracts, while purchasing protective put options to hedge CORE’s price risk. All rewards are converted back into BTC and paid out to depositors at maturity, ensuring net returns are denominated in Bitcoin rather than platform tokens.

High Yield Secured - Maple’s high yield secured pool is an overcollateralized lending pool that supports a wider range of collateral where a portion of that collateral can be reinvested via staking with another institutional service provider or secured lending opportunities. Supported collateral assets include BTC, ETH, SOL, BNB, XRP, FIL, ADA and AVAX. Naturally, the target collateralization ratios are higher at 150-500%

44.5% of collateral is reinvested in institutional staking to generate additional yields with the pool remaining heavily collateralized with 440% collateralization. As of the most recent collateral report (19 May), collateral is mainly distributed in cash management strategies (Sky-SSR, $2.8M) and ETH native staking ($136M). This strategy provides the pool a target rate of 12% APY for 2025.

Blue Chip Secured - Maple’s blue chip secured pool is an overcollateralized lending pool accepting only top-tier crypto collateral (primarily BTC and ETH). The pool’s collateralization ratio is currently 283%. The conservative design (Blue Chip collateral + strict underwriting) offers institutional lenders a stable yield (~10% net) that has generally outperformed base DeFi rates. Borrowers benefit from relatively lower interest for posting high-quality collateral, while lenders gain security via margin calls and custody of blue-chip assets.

This strategy provides the pool a target rate of 8.45% APY for 2025.

High Yield Corporate Loans - Maple’s corporate loan pool is tailored towards offering strategic financing to well-established credible counterparties, typically concentrating exposure to just a single (or few) entities. The borrower’s identity is shared under NDA to interested lenders, which Maple describes as '“high-quality institutions”. An example illustrative term sheet between Maple and Galaxy Digital:

Loans in this pool are likely unsecured or lightly secured, backed by the corporate’s balance sheet and legal agreements rather than on-chain collateral (hence “corporate loan”). To compensate for this credit risk, the pool’s APYs are generally higher. For example, the Corporate USDC pool offers ~11%, WETH pool offers ~5%. Across the USDC and WETH corporate loan pools, Galaxy Digital is the primary counterparty with outstanding loans on both (~$8M in USDC, ~$5M in WETH).

Additionally, loan tenors are shorter with a shorter call cycle. Lenders in the USDC pool can request withdrawals every 30 days, and 45 days for the WETH pool (with interest paid and loans potentially rolled or refinanced monthly).

Receivables Financing - Maple’s Receivables Financing pool (managed in partnership with AQRU and Intero Capital) is an RWA pool focused on short-term government-backed receivables. Launched in late January 2023, it purchases U.S. IRS tax credit receivables (e.g. Employee Retention Tax Credit claims) from businesses at a discount. Essentially, the pool pays cash advances to firms owed tax refunds to provide them with quicker access to liquidity and once the U.S. Treasury pays the refund, the pool earns the difference.

The average time between purchasing a receivable and it being settled by the IRS is 106.59 days during the most active period of the pool in 2023.

This pool’s design provides exposure to yield-generating TradFi assets with low credit risk (the obligor is the U.S. government). The receivables pool currently has 2 outstanding loans worth ~$9M total that were recently originated. The gap was due to the decrease in settlement time by the IRS and a shift from yield-generating to growth assets during that period.

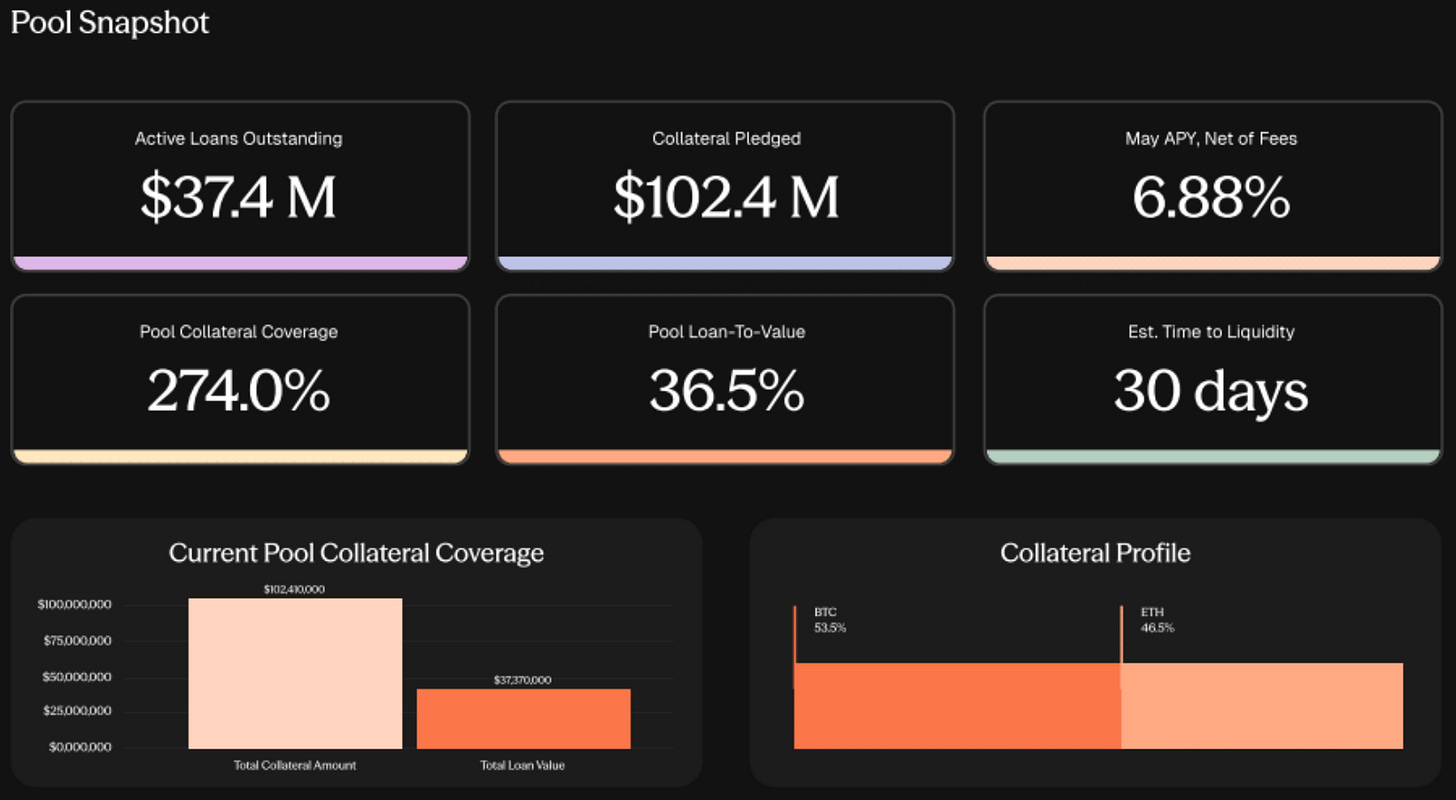

Maple 2.0 Lending Products: SyrupFi

Launched in mid-2024, Syrup is Maple’s permissionless secured lending pool designed to “democratize” access to Maple’s institutional lending opportunities. Their 1-pager advertises a simple-to-use, secure DeFi lending product (*cough* hodlnaut, celsius ptsd):

Since Syrup’s launch in mid-2024, it has garnered an AUM of over $1.5B to-date.

Under the hood, when a user deposits USDC or USDT into a Syrup pool, the funds are routed through Maple’s smart contracts (an ERC-4626 “tokenized vault” contract) and pooled for lending. The depositor receives an LP token (syrupUSDC or syrupUSDT) representing their share of the pool, and yield accrues to this token as loans generate interest.

Syrup acts as a yield aggregator that gives users exposure to Maple’s institutional loan book without direct KYC or large minimums. SyrupUSDC/T yield is derived from a blend of Maple High Yield Secured and Blue Chip Secured lending pools. Originally, SyrupFi was launched as a separate front-end (Syrup.fi), but is now unified into Maple’s main app as part of the “One Maple” initiative.

Syrup pools currently quotes a 10-15% target APY (more on APY later) to depositors, reflecting the yield of the underlying loan portfolio + drips.

Collateral and Allocation

Underlying loans in the Syrup pool still adhere to Maple’s frameworks, where loans are overcollateralized, and collateral is held with institutional-grade custody solutions (BitGo), and Maple provides on-chain addresses for lenders to verify the collateral details for each outstanding loan. Maple’s team also underwrites and structures these loans using the same rigorous due diligence applied to its institutional offerings.

BitGo has a $250 million insurance policy covering loss, theft, or misuse. All client assets custodied by BitGo remain bankruptcy-remote from both BitGo itself and Maple Finance.

The Syrup pool takes a hybrid approach where currently it is 86% collateralized by BTC, with the remaining 14% in altcoins or even DeFi assets like Pendle PTs, Lombard LBTC, USR LP tokens, etc.

Syrup Architecture & Legal Structure

Each Syrup pool (one for USDC and one for USDT) is a standalone Maple lending pool contract, created specifically for Syrup lenders so that the funds do not commingle and any risks are isolated.

In terms of legal structure, Maple constructs a segregated bankruptcy-remote LLC for each individual pool, ensuring that the assets and liabilities of a given pool are isolated in the event of legal or operational failures.

Syrup pools utilize a Special Purpose Vehicle (SPV) structure that serves a similar purpose of legal isolation, but is designed to streamline and generalize access for non-institutional lenders in a permissionless setting. It segregates lender funds from Maple Finance’s corporate balance sheet and ensures that pool assets are protected in the event Maple becomes insolvent.

Defaults and Impairments within the Syrup pool work similarly to how it does in Maple Direct pools where unrealized losses are socialized and the withdrawal exchange rate is marked down.

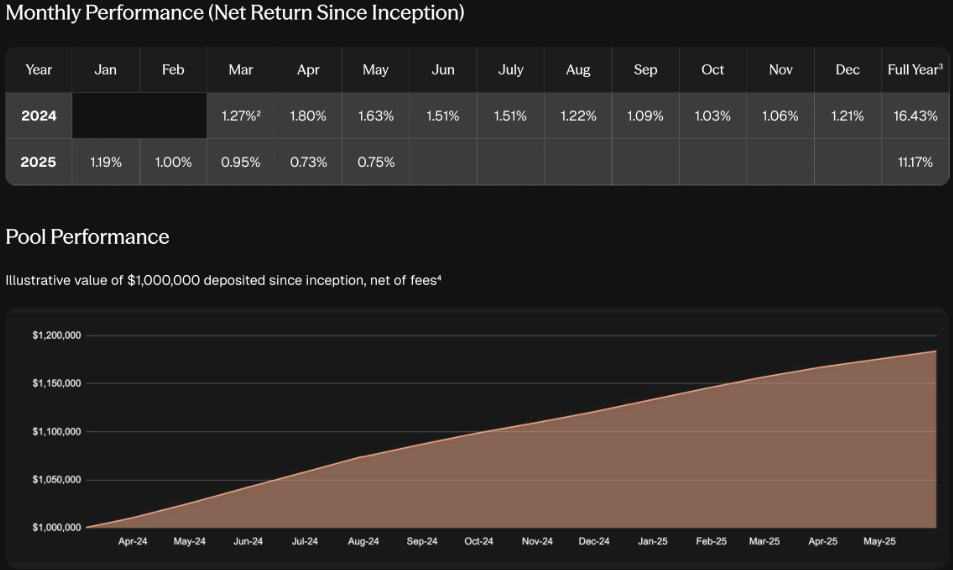

SyrupUSD Yields

SyrupUSDC/T yields are derived from 2 sources:

Native yield which comes from lending to institutional borrowers. This includes the raw weighted interest payments (minus protcol fees) from blue chip and high yield lending, and yield-generating DeFi collateral (similar mechanic to High Yield Secured Lending pool collateral). Since the vault standard is ERC-4626, lenders will see their balance grow via an increasing exchange rate.

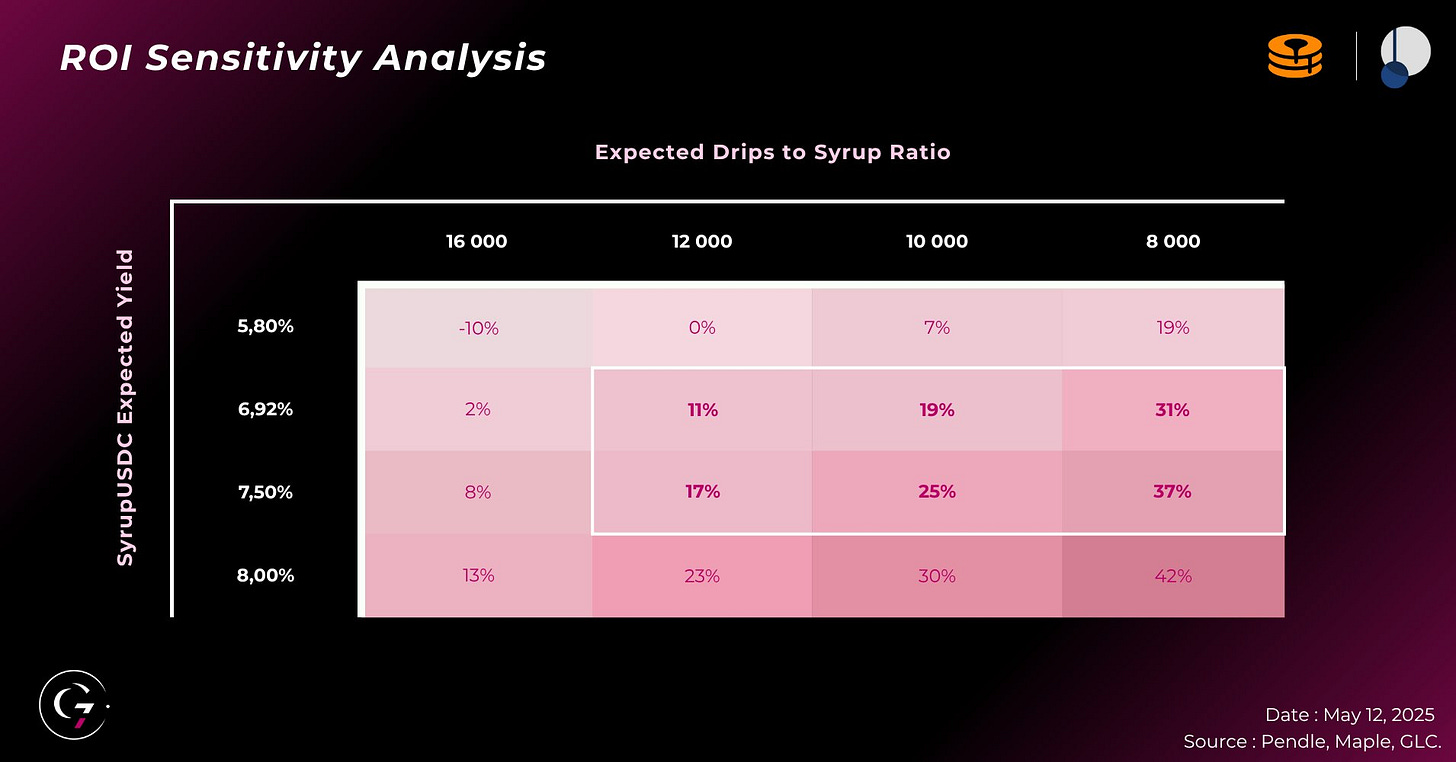

Source: Maple Drip yield is the supplementary incentive layer designed to enhance APY and bootstrap capital formation for lending. Drips are distributed as $SYRUP token rewards and are funded from Maple’s token emissions. Drips compound every 4h and users earn a Drip bonus of 1.5x to 3x for locking their pool deposit for 3 and 6 months, respectively. Drips work in seasons with each season having it own reward structure and conversion of Drips to SYRUP.

Combined, Syrup yields have yielded an average ~20% APY.

Drips are currently in Season 10 which has since changed into a quarterly yield payout which creates a greater long-term alignment compared to a monthly system from Season 1 to 9. The range has averaged ~3-6K drips per SYRUP.

SyrupUSD LP Token DeFi Use Cases

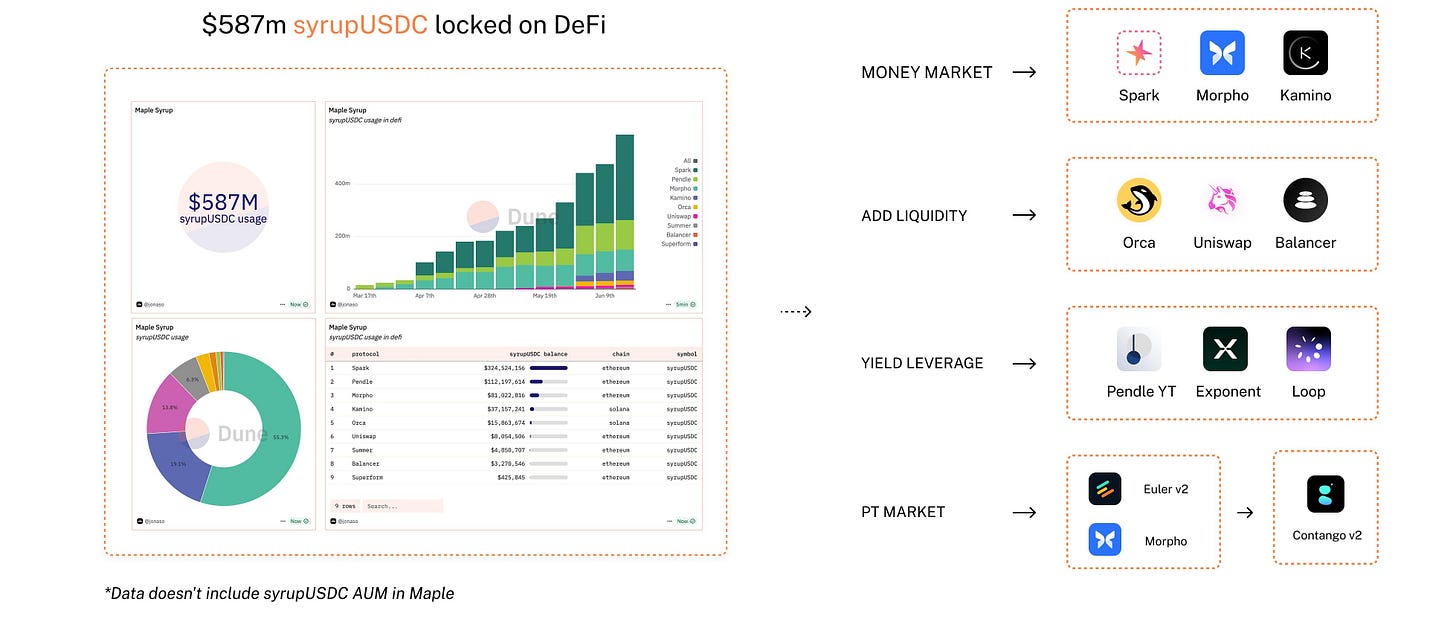

SyrupUSDC/T LP tokens are composable assets that can be used across DeFi. These tokens function like interest-bearing stablecoins, making them attractive as collateral or liquidity in other protocols. The following protocols support SyrupUSDC in various products (credit: Jonasoeth on X)

Spark has the largest allocation to SyrupUSDC (currently >$400M), allowing USDS stakers to tap into institutional loanbooks. It currently forms part of the backing of USDS, contributing yield to the Spark Savings Rate.

Maple partnered with Pendle to unlock fixed-rate and yield trading opportunities on syrupUSDC. Pendle created markets for syrupUSDC where the yield-bearing token is split into PTs and YTs. Maple incentivized Pendle’s launch by offering a 5x Drips reward boost for Pendle users interacting with syrupUSDC

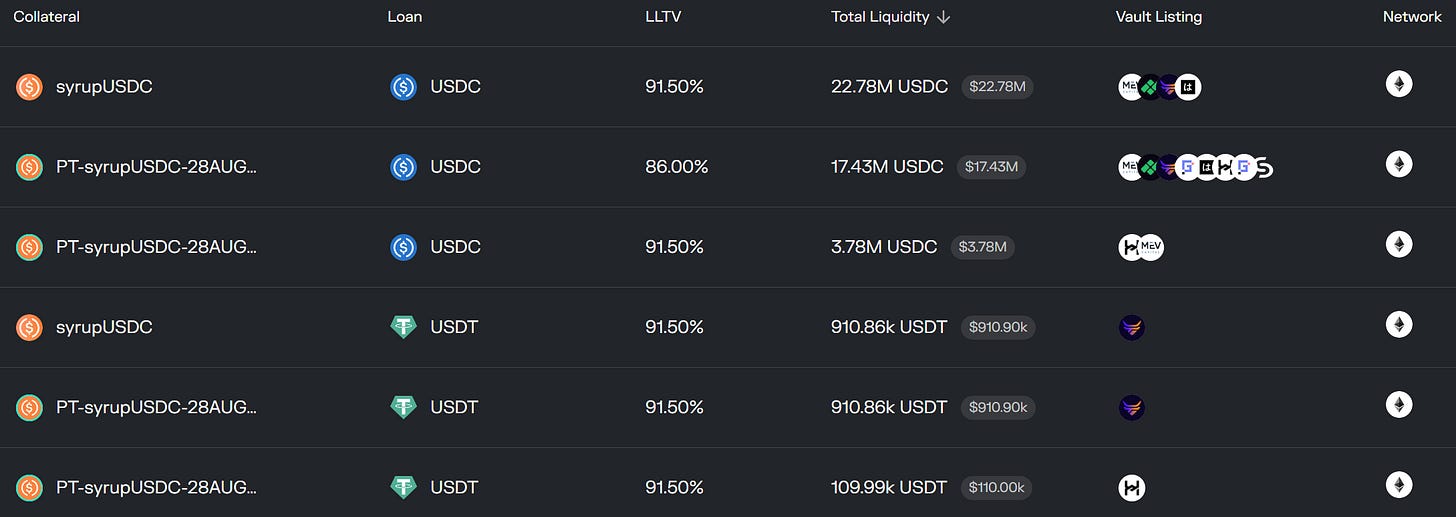

SyrupUSDC was listed on Morpho, allowing users to supply syrupUSDC, and even Pendle PTs as collateral and borrow USDC/T against it. Gauntlet and MEV Capital curated the initial SyrupUSDC market on Morpho with an LTV of 91.5% and a borrow rate of 6-7%, allowing users to do a classic leverage loop (+ additional Drip rewards) and position SyrupUSDC as a core DeFi yield asset as money market collateral.

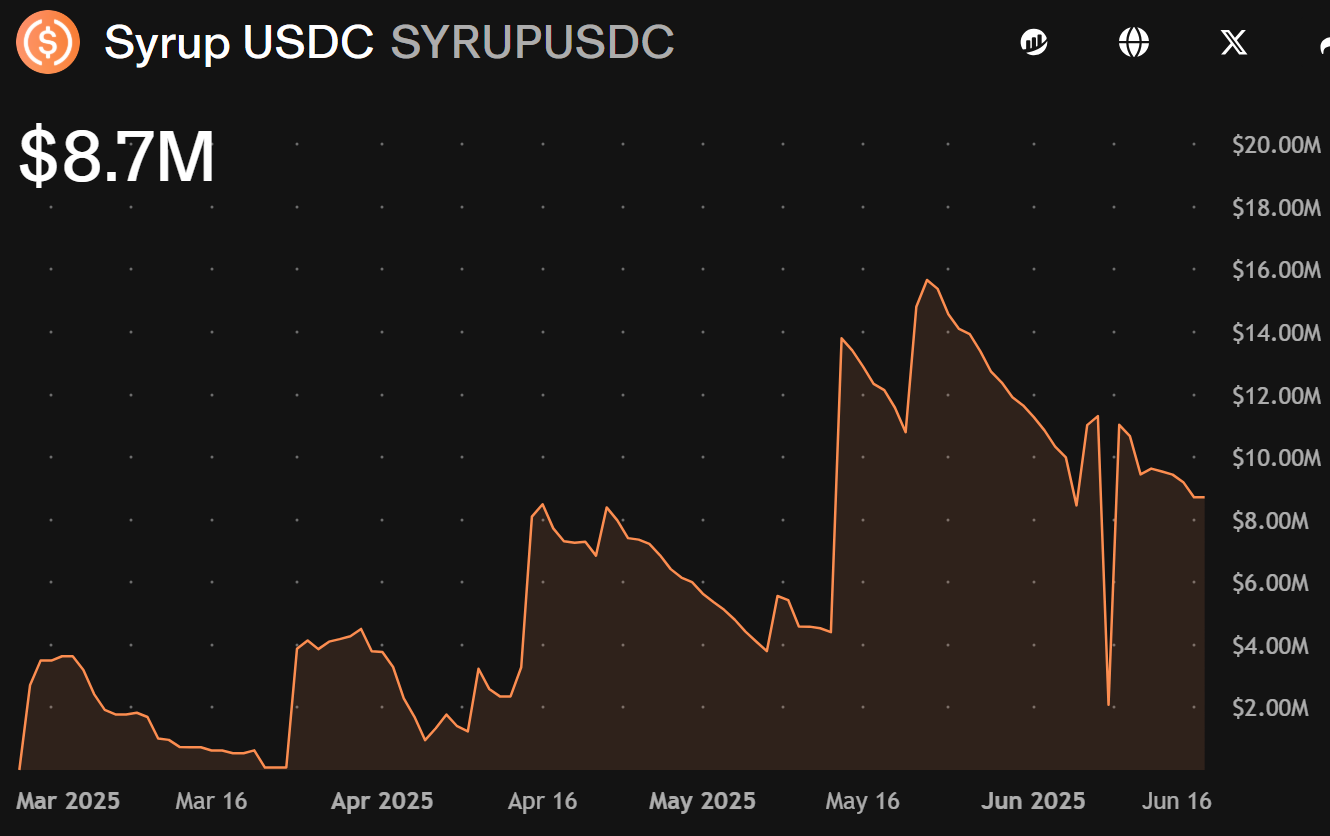

SyrupUSD LP tokens have also been integrated as SyrupUSDC/USDC liquidity pairs on Uniswap and Balancer, allowing lockers to instantly trade in and out on secondary markets at a fee. Over $10M in liquidity are available across these 2 pools.

Protocol Fees

Maple Finance generates revenue through fees on its institutional lending activity, primarily via management fees, service fees and origination fees (for fixed-term loans). These are the loan-level fees which are paid to either the pool delegate that manages the pool that funded the Loan or the Maple treasury. These fee parameters can be set in the governor contract and predetermined between the loan parties.

Origination fees are paid by borrowers at the initial loan funding or refinancing for fixed-term loans.

Service fees are paid by borrowers during interest repayments. This applies to both fixed- and open-term loans.

Management fees are paid by borrowers during interest payments with the remainder going to the lender. This applies to both fixed- and open-term loans. Most open loans currently set this at 0.25%, e.g.

Another tier of fees are the DeFi strategy fees. This applies primarily to any additional yield generated through DeFi strategies (e.g., liquid staking of collateral) which are deployed in the High Yield Secured Pool.The fee is structured as a cut of outperformance (with a cap at 100) which reflects Maple’s alignment with LPs on alpha capture from additional yields.

$SYRUP Migrated Tokenomics & Emissions

The current total supply of $SYRUP is 1.15B, with a 1:100 conversion ratio from $MPL to $SYRUP. In MIP-009, a 1-time issuance of 1M $MPL was proposed, along with an annual inflation of 5% per annum with the goal of recapitalizing the Maple Treasury. At the time of migration, a total of 549.3K $MPL was emitted. Thus, the 1.15B $SYRUP supply.

Assuming steady issuance at 5% p.a., the total supply is expected to climb to approximately 1.23 billion by late 2026. Emitted tokens fall into two primary categories:

Staking Rewards (20%)

Currently, 20% of token inflation go directly to SYRUP stakers to incentivize active governance participation. These go toward staking APY. (This works out to ~1% of annual total supply)

Treasury Recapitalization (80%)

The majority of inflation funnels back into the Maple Treasury, funding protocol operations, ecosystem growth, and strategic initiatives like pool underwriting or DeFi integrations.

A portion of the treasury-held SYRUP is allocated as Drip rewards to specific lending pools including the Syrup pool commits which enhances LP returns beyond native yield. The distribution is subject to on-chain governance and can be adjusted.

$SYRUP Staking

MIP-010 introduced real yield proposing fee revenues generated from Maple’s and Syrup.fi’s lending operations to be used to buy back the SYRUP token on the open market quarterly to be redistributed as yield to stakers. MIP-013 (passed Jan 2025) specifically put the percentage at 20%. This was positioned as a moderate trial (Q1 2025) to share value with long-term aligned token holders without drying out funds for operations.

Currently, just over 40% of total SYRUP supply is staked, ~450M tokens. To work out the implied APY for each month:

Annual emission for 2025 works out to 59.5M tokens, roughly 14.9M/quarter. ~3M going to stakers works out to 0.624%/quarter (~2.5% base implied APY).

On top of that, revenue buybacks (which are done end of each month) is like the variable component. The current implied APY of 2.9% does not represent June revenue estimates (currently ~980k, 1M as a vibe figure). On month end it should be ~3.2% for staking yield.

Net Token Flow

Per MIP-013, ~50M in emissions would go to the treasury which could be sold to fund operations or deployed as incentives, but they are not automatically dumped on the market. At current annualized revenue of ~$10M, there likely won’t be an operating shortfall which requires selling SYRUP to cover the difference.

Drips paid to lenders are funded from the treasury’s 80 % share of inflation, and recent changes to the Drip yield accruals to quarterly means more SYRUP enters circulation in one go. ~41B drips have been allocated up till season 9, at an avg 1.5M SYRUP each season (monthly).

With ~32B outstanding drips this season, and using sensitivity analysis from GLC Research’s base case of 8-12K drips per SYRUP, ~2.7M - 4M SYRUP is expected to be paid out at the end of season 10 (end Q2).

20% of revenue being allocated to open market buybacks which temporarily removes ~3.6M tokens annually (@$0.55) from circulating supply and paid to stakers. Because a majority of stakers are compounding (assuming they continue to..), they are effectively taken off the liquid market. The concern lies in that trust in non-profit-taking has never been sustained by any protocol in the long-term.

And as pointed out in MIP-016, there is a real concern that the buyback-and-distribute model + relatively risk-free staking of SYRUP (0 lockup) doesn’t benefit the protocol long-term, instead shifting sell pressure into the hands of stakers on top of the added dilution. The argument is for protocol revenue to be better spent on growth incentives (lender subsidies, borrower incentives) or burned outright to guarantee lasting scarcity, benefiting all holders.

Valuation Projections

(all figures are forward-looking to YE-2027)

Takeaway:

Base case - At an attainable $25B TAM and 13% Maple share, fee rev scales to $25 m. Capitalised at a peer-median ~50x P/F, the model implies $1.25B FDV and ∼$0.9 - $1.00 per SYRUP. (Roughly +72% from today’s prices).

Bear case - A bear trajectory of slower TAM growth ($20B) and 9% APR compression still supports $0.31 (-44%).

Bull case - A bull trajectory returns ~$40B TAM, 13% share, 13% APR, ~65x P/F lifts price to $2.28 (~3.14×).

Model

The projection is based off of 3 primary matrices, starting from a top-down estimation of onchain private credit TAM and Maple’s future % share of the market → Translate that loan book into fee revenue → Converting those fees against a range of peer-comped P/F multiples to arrive at the implied FDV.

Loan Book Size

$25bn as the base case assumes the on-chain private credit market merely grows ~40% CAGR from today’s $14bn. The base case is that Maple achieves a 13% share from 8% today which is ~140bps/year, thus yielding a loan book of ~$3.3B.

Annualized Fees

>80% of the book seems to be open-term, so the origination term is small and the driver is more of interest-related fees. The fee ranges across a 9%/ 11 %/ 14% borrower APR band, reflecting current pool-weighted rates (~10.9%).

Crossing that with the current loan-book and a 7% fee-take (rough estimate avg of management and service fees) produces today’s ~$10M annualized rev on tokenterminal.

Formula: Fees = Loans × Weighted APR × 7 %,

Implied FDV/Price per SYRUP

$25M fee revenue by YE-2027, which, under peer multiples of 50x, maps to a 1.25B FDV. Based on total supply estimations (1.3B rounded) after accounting for inflation, this would give a range of $0.90 - $1.00 per SYRUP.

No mention of inflations after end-2026, but if we consider the sensitivity, every 1% (~12.6M tokens) in annual inflation trims base-case price by ~1%.

Conclusion

Maple offers one of the clearest trades into a structural trend of institutional support for DeFi and stables. SYRUP has outperformed most peers since its inception in May but there is a risk of volatile mean-reversions to peer 30-50x P/F comps (~$0.30-$0.40 price range). Despite this, the overall thesis remains intact and ideally look to add during a broader market shakeout.

Thanks for reading!

DISCLAIMER: The information, opinions, and projections contained in this report are provided exclusively for discussion and educational purposes. They do not constitute investment, legal, accounting, tax, or other professional advice and should not be relied upon to make, or refrain from making, any investment decision. You should perform your own independent analysis (including consultation with appropriately qualified advisers) before acting on any information presented herein.

All quantitative data, including but not limited to total‐value‐locked, loan balances, annualised fee revenue, token-supply figures, APRs, and price-to-fee multiples, were gathered from publicly available sources such as TokenTerminal, DefiLlama, RWA.xyz, Dune, the Maple Finance subgraph, and protocol dashboards. Wherever possible those figures were cross-checked against on-chain contracts. Nonetheless, historical metrics can be restated and dashboards may contain errors. No representation or warranty, express or implied, is given as to the accuracy, completeness, or correctness of the data as of either the pull date or the date you are reading this report.

The author currently holds a personal position in SYRUP tokens acquired at or near the protocol’s inception and may buy or sell such tokens at any time without notice. This creates an inherent conflict of interest that could consciously or unconsciously influence the analysis, tone, and conclusions contained herein. Readers should assume the author is biased in favour of the project.